|

|

|

|

|

|

|

|

|

|||

|

|

|

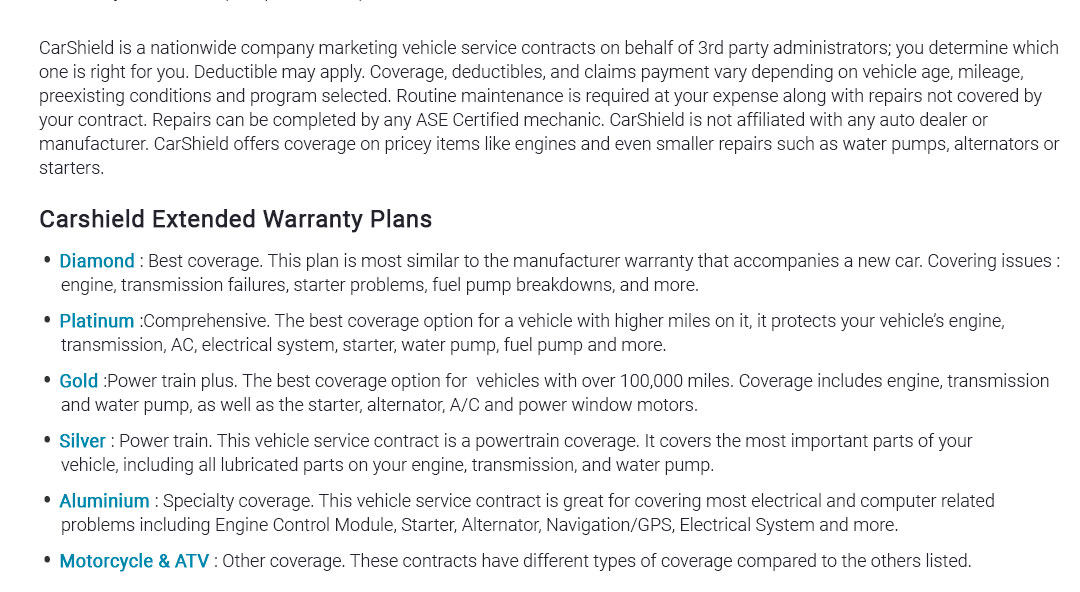

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

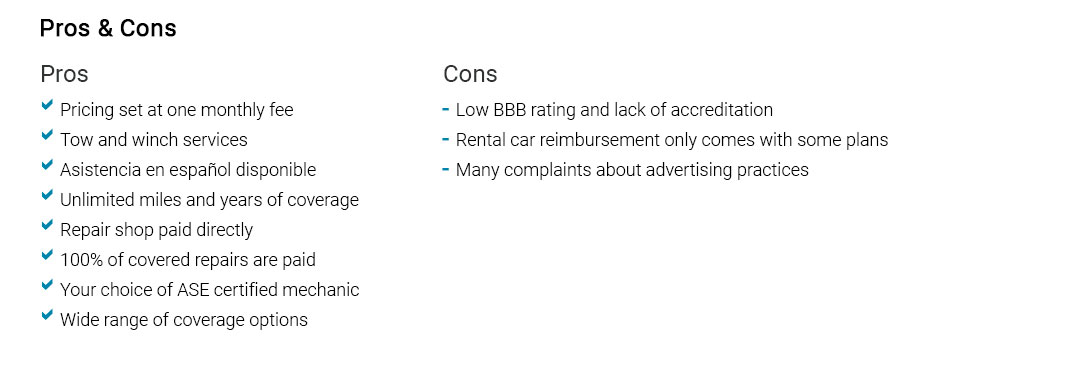

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

ford protect extended warranty: a skeptical guide to real savings and smarter comparisonsWhat it is, and what it isn'tI treat Ford's official coverage as a tool, not a promise. The Ford Protect program extends coverage past the factory warranty with tiers like PremiumCARE, ExtraCARE, BaseCARE, and PowertrainCARE. You choose term, mileage, and a deductible per visit. It's backed by Ford, typically transferable, and often includes roadside help and rental benefits. It's not magic. Wear items, maintenance, and cosmetic issues are generally excluded. Claims still follow diagnostics and authorization steps, and the deductible applies per repair visit, not per part. Savings: where the math actually worksI only warmed up to it after looking at potential repair clusters. Electronics are the modern wildcard; a single control module can cost more than a year of routine maintenance. Turbocharged engines, AWD components, and advanced driver-assistance sensors also concentrate risk.

I said "less likely," but that's too blunt. More precisely, the benefit narrows if your repair exposure is low and you're disciplined about saving cash for surprises. A quick comparison framework

One real-world momentOn a weekend run to see family, the infotainment froze, then the screen went dark. Not catastrophic, but navigation and climate shortcuts were gone. Dealer said the module had failed; coverage authorized replacement and a rental. I paid the deductible, not the large parts-and-labor total. The rental coverage mattered more than I expected. What I liked, and what tested my patience

How to read the fine print fast

Alternatives worth sanity-checking

Price vs. protection: a simple lensAsk one thing: does the quote feel smaller than one serious out-of-warranty repair you'd realistically face? If yes, and the coverage aligns with your risk profile, it's reasonable. If no, self-funding may be cleaner. Decision snapshot

Bottom line: I'm skeptical by default, but not dismissive. With the right tier, a fair price, and honest ownership plans, Ford's coverage can shift risk off your plate and keep cash flow predictable. Just do the math, compare ruthlessly, and don't buy more than your actual exposure.

|